The accommodation sector showed steady growth in both supply and demand during the 2024–25 financial year.

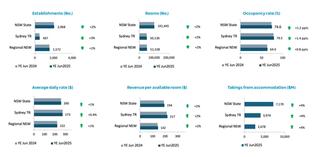

The NSW market comprised of 2,068 establishments and 101,445 rooms, with both seeing a two per cent rise on the previous year.

Regional NSW accounted for 76 per cent of the establishments and 51 per cent of the rooms.

Regarding demand, NSW’s average occupancy increased modestly by one percentage point to 74.6 per cent.

Sydney Tourism Region (TR) maintained a high occupancy rate

of 79.5 per cent (up one percentage point), while regional NSW also recorded a one percentage point lift to reach 64 per cent.

The average daily rate (ADR) showed moderate growth across the state, increasing one per cent to $260.

Sydney achieved an ADR of $273 (up 0.4 per cent), while regional NSW also recorded a modest increase of one per cent to $222.

Revenue per Available Room (RevPAR) reached $194 statewide, supported by a two per cent rise in both the Sydney TR and regional NSW.

Revenue from accommodation in NSW reached $7.2 billion, increasing four per cent on the previous year.

Growth was equal across the state with both Sydney TR and regional NSW up by four per cent.

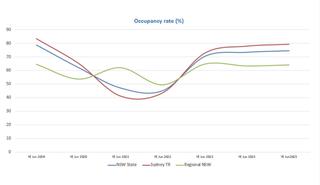

In the 2024–25 financial year, both NSW and Sydney TR recorded their highest occupancy of 74.6 per cent and 79.5 per cent since the COVID-19 pandemic.

Occupancy rebounded strongly to approximately four percentage points below pre-COVID-19 levels.

Regional NSW almost reached the pre-COVID-19 level of occupancy of 64.4 per cent.

Note: this overview defines establishments as commercial lodging facilities with 10 or more rooms.

Short-term rental accommodation

The short-term rental accommodation (STRA) market saw notable growth in supply and demand in the 2024–25 financial year.

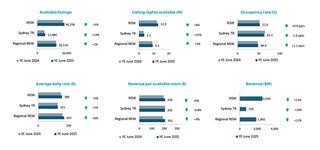

Total available listings averaged over 46,250 per month, adding 2,252 new listings compared to the previous year.

Sydney TR experienced the largest growth in average available listings, increasing 14 per cent.

Regional NSW, which accounted for 70 per cent of all available listings in NSW, recorded a two per cent rise.

Statewide, there was a six per cent rise is listing nights available, led by a 15 per cent increase in Sydney TR.

With the strong supply growth compared to the previous year,

occupancy rates for NSW rose only slightly, increasing by a 0.9 percentage point to 52.6 per cent.

The ADR in NSW climbed five per cent to $389, with a six per cent increase in regional NSW driving this growth.

RevPAR reached $204 statewide, up six per cent. Regional NSW’s increase of nine per cent offset a slight decline in RevPAR for Sydney TR (down 0.8 per cent).

Total STRA revenue for NSW rose to $2.6 billion, up 13 per cent on the previous year.

Revenue growth was seen across the state with Sydney TR up 14 per cent and increase in regional NSW up 12 per cent.

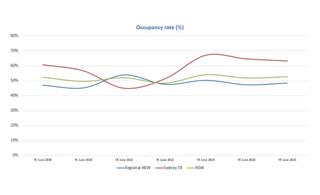

Looking at the annual average occupancy rates since the 2018–19 financial year, Sydney TR in the 2024–25 financial year remained at a high level with 63 per cent occupancy, although it fell slightly below the post-COVID-19 peak seen in the 2022–23 financial year.

The state occupancy was 53 per cent in the 2024–25 financial year, up 0.9 percentage point from the previous year.

Regional NSW occupancy rates also increased by 1.1 percentage points to reach 48 per cent.

Note: not all market listings are captured in this overview. AirDNA captures listings on Airbnb and VRBO which covers the majority of STRA market in Australia.

.jpg?fp-x=0.5&fp-y=0.6456534808820433&w=320&h=180&fit=crop&crop=focalpoint&auto=format)